IP basics in Life sciences

Last time, we discussed Patent Invalidation Trials as the most powerful way to fight back when accused of patent infringement. Countering an alleged patent infringement lawsuit with a patent invalidation challenge is one of the most aggressive forms of patent-based competition. However, litigation and trials—regardless of whether one wins or loses—require significant time and cost, placing a heavy burden on the companies involved.

There is, however, an alternative approach: licensing patent rights to generate revenue while expanding the market. In such cases, the challenge lies in how to initiate negotiations and steer the parties toward a mutually beneficial agreement. One notable example where these challenges were skillfully overcome is the Opdivo–Keytruda case, in which competitors managed to coexist in the market while achieving successful monetization.

In this column, I will introduce the patent dispute over these two major antibody therapeutics that attracted worldwide attention.

Vol. 8: Monetization from Litigation to Licensing

The Opdivo vs. Keytruda Patent War

What is Opdivo [Note 1]?

Opdivo is an anti–PD-1 antibody used in cancer treatment and is classified as an immune checkpoint inhibitor called nivolumab. Anti–PD-1 antibodies bind to PD-1, the “immune brake” found on the surface of T cells, and block the mechanism by which cancer cells use PD-L1 to suppress T cell activity. As a result, T cells become activated and exert anti-tumor effects.

Opdivo was discovered and developed by Dr. Tasuku Honjo and Ono Pharmaceutical, and in July 2014 it became the first PD-1 immune checkpoint inhibitor in the world to receive regulatory approval—granted in Japan for malignant melanoma. Dr. Honjo’s achievements in this field are widely known, culminating in his receipt of the Nobel Prize.

Outside Japan, the patent has been licensed to Bristol Myers Squibb (BMS), with whom the drug was co-developed.

Patents for Opdivo

Dr. Tasuku Honjo and Ono Pharmaceutical jointly obtained two Japanese patents. The scope of rights (the inventions described in the claims) is as follows:

Patent 1) JP 4409430 B “Immunostimulatory Composition”

Filed: July 2, 2003 (with patent term extensions of up to 5 years)

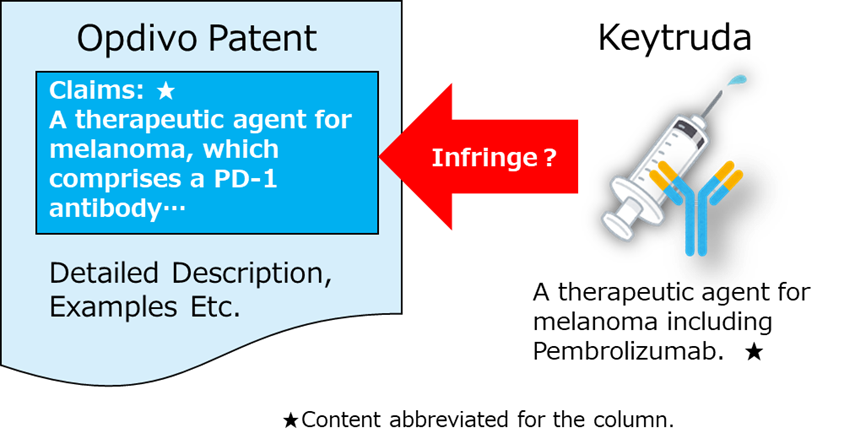

Claim 1: A therapeutic agent for melanoma comprising an anti–PD-1 antibody as an active ingredient, which suppresses the growth or metastasis of melanoma in vivo.

Patent 2) JP 5159730 B “Monoclonal Antibody”

Filed: July 2, 2003 (with patent term extensions of up to 5 years)

Claim 1: A therapeutic agent for cancer comprising an anti–PD-1 antibody as an active ingredient, which suppresses the growth of cancer cells in vivo (excluding melanoma therapeutic agents).

These patents are so-called “use patents,” which define the invention based on the therapeutic use of the active ingredient. The active ingredient is not specified by the amino-acid sequence of a particular antibody, but rather by its function, namely, an “anti–PD-1 antibody.” Therefore, any antibody that functions as an anti–PD-1 antibody, not only nivolumab, falls within the scope of these patents.

As for the claimed uses, JP 4409430 B covers a “melanoma therapeutic agent,” while JP 5159730 B covers a “cancer therapeutic agent (excluding melanoma therapeutic agents),” thereby encompassing a broad range of cancer treatments. In this context, “use” corresponds to the indications and efficacy of a pharmaceutical product.

The filing date of these patents was July 2, 2003, meaning the standard 20-year term would end on July 2, 2023. However, both patents have been extended by using the PTE system introduced in the Volume 4, and their expected expiration date is July 2, 2028 [Note 2].

Keytruda [Note 3]

Keytruda is also an anti–PD-1 antibody, known as pembrolizumab. Although its epitope—the binding site on the target—and its amino acid sequence differ from those of nivolumab, the mechanism of action is the same. MSD developed Keytruda by applying its research on PD-1.The drug received its first approval for malignant melanoma in September 2014 in the United States and in July 2015 in Japan.

The Opdivo Team Sues the Keytruda Team Around the World

After Keytruda received regulatory approval, the “Opdivo Team” (Ono Pharmaceutical and BMS) filed patent infringement lawsuits against the “Keytruda Team” (MSD) in Japan, the United States, Europe (the United Kingdom, the Netherlands, France, Germany, Ireland, Spain, and Switzerland), and Australia.

So, does Keytruda really infringe Opdivo’s patents?!

Settlement and a Licensing Agreement Announced!

Many wondered how this massive, globe-spanning litigation battle would end. As discussions between the two teams progressed, it was announced on January 20, 2017 that they had reached a settlement and concluded a licensing agreement under the following terms:

The Keytruda Team will pay the Opdivo Team a lump sum payment of 625 million USD. In addition, the Keytruda Team will pay running royalties through 2026 as follows:

• 6.5% of global sales from January 1, 2017 to December 31, 2023

• 2.5% of global sales from January 1, 2024 to December 31, 2026

(The allocation between Ono Pharmaceutical and BMS: Ono 25%, BMS 75%.)

Press release from the Opdivo Team:

It appears that the Opdivo Team’s objective was not to drive Keytruda out of the market, but rather to coexist while generating licensing revenue. In a press release, Giovanni Caforio, M.D., CEO of BMS, stated, “Today’s agreement is also a good decision for patients as it supports the continuation of ongoing research and maintains access to anti-PD-1 therapies for cancer patients around the world.”

Opdivo and Keytruda: What Happened Next

These two pioneering cancer immunotherapies continue to rank among the top ten pharmaceutical products in Japan. In 2024, Keytruda recorded the highest domestic sales of prescription drugs at 164.9 billion yen, followed by Opdivo at 164.5 billion yen. Notably, Keytruda has maintained the No. 1 position for 27 consecutive months through December 2025 [Note 4].As the BMS CEO commented, both drugs have indeed expanded access to cancer immunotherapy and helped countless patients.

What would have happened if, instead of pursuing a license, the Opdivo Team had continued to assert patent infringement and the Keytruda Team had fought back head-on with invalidation trials?

If Keytruda had been barred from the market, Opdivo alone might not have been able to meet market demand. Conversely, if Opdivo’s patents had been invalidated, generic products (biosimilars) might have entered the market much earlier.Considering these possibilities, the Opdivo Team’s strategy—choosing to coexist with a competitor while generating revenue through its patent rights—can be regarded as a major success.

This case was a patent battle between two brand-name drugs, but patent battles between brand-name and generic drugs begin with efforts to block the generic product’s marketing approval.

In the next installment I’ll explore why some generic drugs never make it to approval—and the powerful mechanism behind it: patent linkage.

Stay tuned!

Note 1: “Opdivo” is a registered trademark of Ono Pharmaceutical Co., Ltd.

Note 2: There are also patent term extensions that expire earlier than this.

Note 3: “Keytruda” is a registered trademark of Merck Sharp & Dohme LLC.

Note 4: Nikkan Yakugyo, January 8, 2026,

“Keytruda Maintains No. 1 Position for 27 Consecutive Months — December Ensight Data.”

https://nk.jiho.jp/article/204604

Author Profile

Yasuko Tanaka

President & Patent Attorney, S-Cube International Patent Office / CEO, S-Cube Corporation

Outside Director, Strategic Capital Inc.; Part-time Lecturer, Tokyo University of Agriculture and Technology Graduate School; Expert Commissioner in Intellectual Property Litigation

Previously served in the intellectual property departments of Teijin, Pfizer, and 3M Japan, with extensive experience in domestic and international IP practice, IP strategy development, contract negotiation, IP education, and project management. Founded S-Cube Corporation in April 2013 to strengthen global competitiveness of Japanese companies through IP strategy, and subsequently established S-Cube International Patent Office in August 2013 to provide seamless services including patent prosecution. Holds a B.Sc. in Biochemistry from Chiba University (1990).